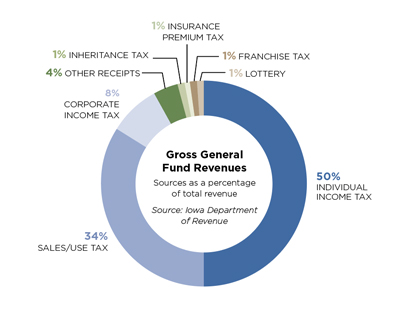

iowa inheritance tax rate

This is a tax on the right to receive money or property owned by the decedent at the time of death. It has an inheritance tax with a top tax rate of 18.

What States Have Inheritance Tax

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

. Read more about Inheritance Tax Rates Schedule. Inheritance tax in Iowa is based on the heirs relationship with the deceased. Which is better than our neighboring state of Nebraska which has the highest top inheritance tax rate of 18 In case you were.

The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. The last of the 6 states is Nebraska. 619 a law which will phase out inheritance taxes at a.

Does Iowa have an inheritance. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons. Learn About Sales.

If the net value of the decedents estate is less than 25000 then no tax is applied. Iowa collects inheritance tax for inherited property but tax rates depend on the degree of relationship of the beneficiary and the decedent. Iowas estate tax was repealed in 2008.

Iowa is one of several states that have an inheritance tax. If the net estate of the decedent found on line 5 of IA. Beginning in 2021 Iowa started phasing out its inheritance tax over a five-year period by reducing the rate of tax by 20 each year the.

Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. Numerous attempts have been made over the past decade to eliminate or modify the Iowa inheritance tax. That is worse than Iowas top inheritance tax rate of 15.

Aunts uncles cousins nieces and nephews of the decedent. Iowa Estate and Inheritance Taxes. In 2013 the Indiana legislature repealed their inheritance tax completely.

Iowa Inheritance Tax Rates. Iowas max inheritance tax rate is 15. LegalMatch can tell you how you.

Property inherited by a spouse parent grandparent child grandchild or other direct lineal. A bigger difference between the two. Iowa inheritance tax rates If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first.

Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary. Select Popular Legal Forms Packages of Any Category. File a W-2 or 1099.

Iowa Inheritance and Gift Tax. It has an inheritance tax with a top tax rate of 18. If instead you are a sibling or other non-linear ancestor then you are subject to.

All Major Categories Covered. Up to 25 cash back How much inheritance tax each beneficiary owes depends on the beneficiarys relationship to the deceased as well as how much the beneficiary inherited. Schedule B beneficiaries include siblings half.

Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance. Pursuant to the bill for persons dying in the year 2021 the Iowa. There are a number of categories.

Iowa Inheritance Tax Rates. 0-50K has an Iowa inheritance tax rate of. On May 19th 2021 the Iowa Legislature similarly passed SF.

For more information on exempt beneficiaries check out Iowa Inheritance Tax Law Explained. That is worse than Iowas top inheritance tax rate of 15. Learn About Property Tax.

Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. However the state has an inheritance tax that ranges from 1 to 15 depending on the amount of the inheritance and the recipients. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

See General Instructions for Iowa Inheritance Tax Return IA 706. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed.

60-062 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. A summary of the different categories is as follows. It is different from the.

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. The following Inheritance Tax rates will apply to a decedents beneficiary who is a. These tax rates are based upon the relationship of.

60-061 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. How much is the inheritance tax in Iowa. For more information on the limitations of the inheritance tax clearance see Iowa Administrative Code rule70186122.

If the net estate of the decedent found on line 5 of IA. What is Iowa inheritance tax.

Taking An Advice From Right Professional Tax Advisor Help To Manage Your Tax Problems Tax Advisor Tax Lawyer Problem Solving

Tax Talk If You Die In Iowa Is There A State Estate Tax Gordon Fischer Law Firm

Wisconsin Losing Ground To Tax Friendly Peers Tax Foundation

Tax Form 1099 R Jackson Hewitt

Inheritance Tax Here S Who Pays And In Which States Bankrate

Estate And Inheritance Tax Iowa Landowner Options

Retirees Farmers Will See Big Benefits From Iowa S New Tax Law Business Record

Inheritance Tax Which States Who Pays 2021 22 Personal Capital

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Gift And Estate Taxes Captrust

Spanish Citizens And Workers Have Access To Free Healthcare In Spain But What About Expats Here S What Y Healthcare System Health Care Social Security Office

Rich People Are Getting Away With Not Paying Their Taxes The Atlantic

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

Retirees Farmers Will See Big Benefits From Iowa S New Tax Law Business Record